AUDIT NIGHTMARES: Why Subcontractor Compliance is Critical for General Contractors

See How We're Different

or call us: (858) 384‑1506

Imagine this: Your business has just completed a successful year, projects are on track, and you’re ready to focus on new opportunities. Then, your general liability or workers’ compensation audit arrives. Instead of business as usual, you’re hit with a shocking additional premium—tens of thousands of dollars you didn’t budget for. The culprit? Subcontractor non-compliance.

For many general contractors, this scenario is far too common. Carriers are cracking down on subcontractor documentation, and without proper compliance, you could be left footing a massive bill. This blog will explore the hidden risks of neglecting subcontractor compliance and, more importantly, how to protect your business from audit nightmares.

The Real Cost of Subcontractor Non-Compliance

Subcontractor compliance isn’t just a paperwork hassle—it’s a critical safeguard for your business. When general contractors fail to collect proper documentation, the financial and coverage-related consequences can be devastating.

- The Audit Premium: Insurance carriers routinely audit general liability and workers’ compensation policies to verify subcontractor coverage. If proof of insurance isn’t provided, carriers may classify subcontractors as uninsured. This leads to higher premium charges or additional audits, as seen in cases where premium adjustments reached tens of thousands of dollars.

- No Coverage for Claims: Non-compliance doesn’t cost more; it can expose you entirely. Many general liability policies include subcontractor warranty clauses, which require certificates of insurance with additional named insured endorsements and subcontractor agreements to comply. If a claim arises involving a non-compliant subcontractor, your insurer may deny coverage, leaving your business to absorb the financial fallout.

- PRO TIP: READ THE SUBCONTRACTOR AND INDEPENDENT CONTRACTOR WARRANTY IN YOUR GENERAL LIABILITY POLICY!

- Higher Deductibles: Carriers may impose stricter terms during renewals for contractors with poor compliance records, including higher deductibles for claims involving subcontractor work. This creates additional financial strain, especially in cases of high-value losses.

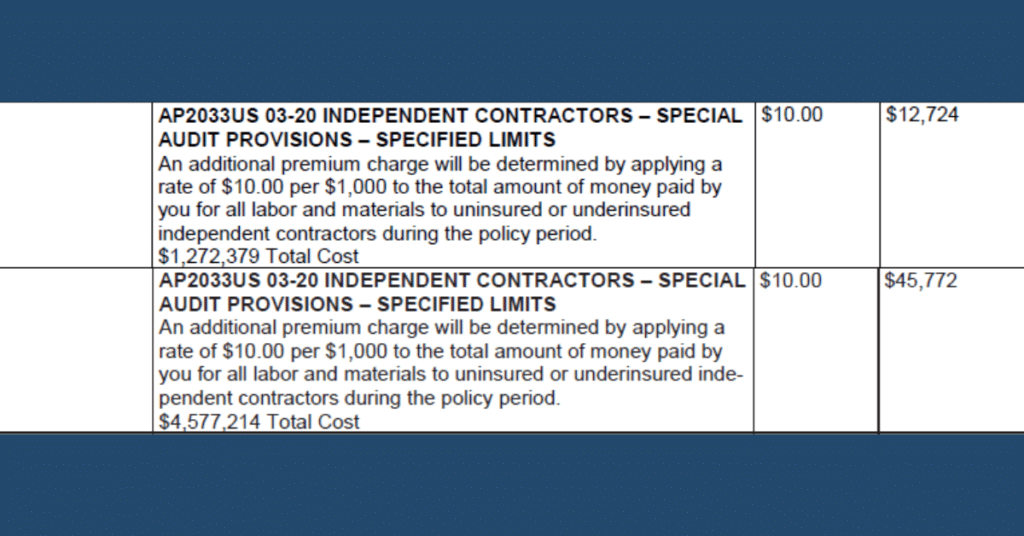

- The Hidden Cost of Non-Compliance: Carrier audits aren’t forgiving. Uninsured subcontractors can result in five- or six-figure premium adjustments, eroding profits, and straining cash flow. General liability carriers typically charge a higher rate per $1,000 of subcontractor costs than gross receipts. Similarly, workers’ compensation carriers may classify uninsured subcontractors or independent contractors in riskier codes, leading to significantly higher rates per $100 of payroll. These adjustments can severely impact your bottom line if proper compliance isn’t maintained.

How to Stay Audit-Ready: Subcontractor Compliance Best Practices

- Collect Certificates of Insurance (COI):

All subcontractors must always require valid COIs before they begin work. Verify that the certificates include the necessary coverage types, limits, and endorsements, such as additional insured status for your company. - Secure Written Subcontractor Agreements:

Use legally binding agreements outlining insurance requirements and hold subcontractors accountable for coverage. These agreements also protect you in case of disputes or claims. - Track Expiration Dates:

Implement a system to monitor the expiration dates of subcontractor policies. Automated reminders can help ensure coverage remains active throughout the project. - Verify Coverage Details:

Don’t just collect COIs—review them carefully. Ensure subcontractors have the correct policy limits, endorsements, and classifications to meet your carrier’s requirements. - Audit Your Records:

Conduct regular internal audits of subcontractor compliance. Identify gaps or inconsistencies before the insurance carrier does during their audit. - Train Your Team:

Educate your staff on the importance of subcontractor compliance and how to manage it effectively. Clear communication and consistent processes can save your company from costly mistakes.

Real Shocks: Examples of Costly Audits

When it comes to subcontractor compliance, the stakes couldn’t be higher. We tirelessly educate our clients on the importance of maintaining proper documentation and insurance for every subcontractor they hire.

The examples below highlight actual audit adjustments general contractors face due to non-compliance. While these premium increases are substantial, they pale compared to the alternative—having an insurance carrier excluding claims involving uninsured subcontractors altogether. Some insurers have strict policy forms denying coverage for such claims, exposing contractors to costly liabilities fully.

Proper compliance isn’t just about avoiding hefty audit bills; it’s about ensuring that your business remains protected when it matters most.

Simplify Compliance with 4C Advising’s Done-For-You Solutions.

Managing subcontractor compliance can feel overwhelming, but it doesn’t have to be. At 4C Advising, we offer comprehensive subcontractor compliance services tailored to general contractors, taking the stress out of the process so you can focus on running your business.

Here’s how our services work:

- Certificate Collection and Verification:

We handle the tedious task of collecting Certificates of Insurance (COIs) from your subcontractors and thoroughly verify each document to ensure all coverage requirements are met. - Automated Tracking and Renewals:

Say goodbye to expired insurance policies slipping through the cracks. Our system tracks expiration dates and follows up with subcontractors to secure updated certificates on time. - Customized Compliance Audits:

We regularly review your records to ensure subcontractor agreements, insurance documentation, and processes align with carrier requirements and industry’s best practices. - Gap Analysis and Recommendations:

Our team identifies potential risks or gaps in compliance and provides actionable recommendations before they become costly issues during an audit. - Expert Advisory Support:

With 4C Advising, you gain access to a team of compliance and risk management professionals ready to answer your questions and provide support when needed.

Securing Your Business Through Compliance

Ultimately, subcontractor compliance isn’t just a box to check—it’s a cornerstone of protecting your business from financial risks and coverage gaps. While the audit bills highlighted here are significant, they serve as a wake-up call to diligent record-keeping, proper agreements, and verified insurance.

Our team is committed to helping our clients navigate these complexities, ensuring their operations are compliant and safeguarded against the unexpected. Don’t leave your business vulnerable—make compliance a priority today.