Employee Benefits Changes Under the One Big Beautiful Bill Act

See How We're Different

or call us: (858) 384‑1506

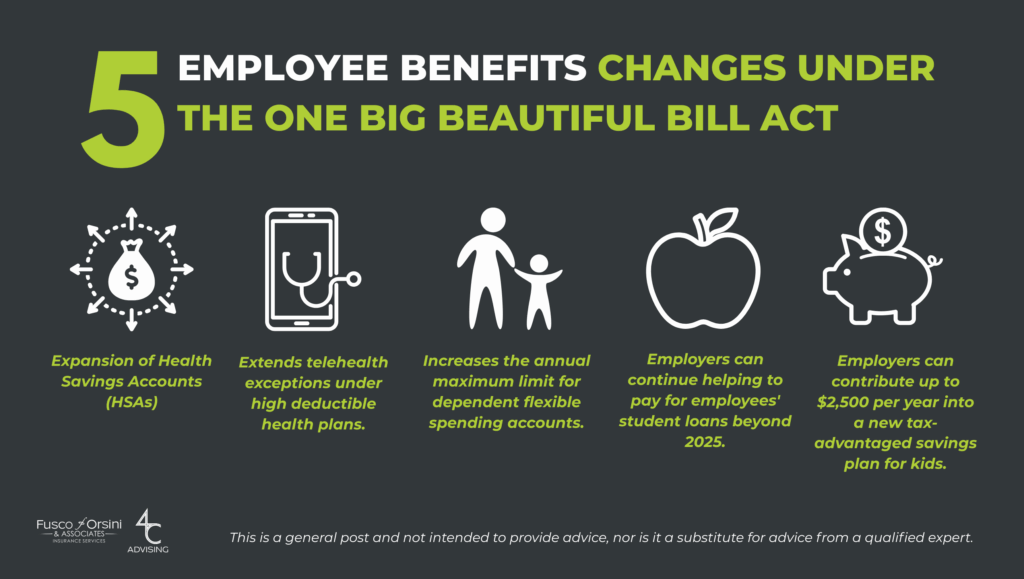

Employee benefits are undergoing changes under the One Big Beautiful Bill Act (OBBBA), which was signed into law on July 4, 2025. Here are five significant updates to consider:

Expansion of Health Savings Accounts (HSAs)

The OBBBA expands the availability of health savings accounts (HSAs) for individuals who are eligible for an HSA.

The key components include:

- The OBBBA treats DPC fees as a medical care expense that can be paid for using HSA funds.

- The OBBBA categorizes as High-Deductible Health Plans (HDHPs) all bronze plans and catastrophic plans that are available through an Affordable Care Act (ACA) Exchange.

Let’s break it down.

DCP

- Effective January 1, 2026, the OBBBA will allow individuals with direct primary care (DPC) arrangements to make HSA contributions if their monthly fees are $150 or less ($300 or less for family coverage).

What is a DPC arrangement?

- According to the American Academy of Family Physicians, “The Direct Primary Care (DPC) model is a practice and payment model where patients/consumers pay their physician or practice directly in the form of periodic payments for a defined set of primary care services. “

Bronze plans and catastrophic plans

- According to Zywave, the OBBBA categorizes as HDHPs all Bronze plans and Catastrophic plans that are available through an Affordable Care Act (ACA) Exchange.

- This change takes effect on January 1, 2026.

- Bronze plans have the highest deductibles and lowest premiums among the four categories of individual plans, while catastrophic plans have lower premiums than bronze plans and very high deductibles.

- This shift means that it is easier for those who purchase coverage through an exchange to obtain an HSA eligible plan.

Extends telehealth exceptions under high deductible health plans (HDHPs)

Employer-sponsored health plans can include covered telehealth services before employees meet their deductibles without jeopardizing HSA eligibility.

Examples of telehealth services include video calls between a patient and a healthcare provider, audio-only calls when a video visit is not feasible, and secure text messaging to address patient questions.

Before the COVID-19 pandemic, telehealth services were subject to the plan deductible on HDHPs, and employees would have to pay the total cash cost for these services. Following the COVID-19 pandemic, telehealth was no longer excluded, and members were no longer required to meet the deductible. This exception has been extended under the OBBBA.

Increases the annual maximum limit for dependent flexible spending accounts (FSAs)

A Dependent Care FSA (DCFSA) is a pre-tax savings account that can be used to pay for eligible dependent care services for your child, disabled spouse, or elderly parent, such as preschool, before or after school programs, summer day camp, and child or adult daycare, so that you can work.

Starting in 2026, the maximum amount employees can contribute to DCFSAs will increase from $5,000 to $7,500 per year for single individuals and married couples filing jointly, and $2,500 to $3,750 for married individuals filing separately. Employees contribute to these accounts with pre-tax dollars.

Employers can continue helping to pay for employees’ student loans beyond 2025

The option to use educational assistance programs for student loans was set to expire on December 31, 2025, but the OBBBA extends this.

Employers can provide their employees with tax-free compensation up to $5,250 per year under a section 127 educational assistance program.

According to Zywave, “educational assistance programs can pay for employees’ books, equipment, supplies, tuition, and other fees. Also, these programs can pay principal and interest on employees’ student loans.”

Starting on July 4, 2026, employers can contribute up to $2,500 per year into a new tax-advantaged savings plan for kids, called “Trump Accounts.”

As of July 4, 2026, employers can contribute up to $2,500 tax-free (indexed) per year into the “Trump Accounts” of their employees’ dependents who are under the age of 18.

“Parents, relatives, other taxable entities and nonprofit and government entities may all contribute,” according to ADP. The total annual contribution limit is $5,000 per year (indexed), including employee contributions. Tax-deferred Trump Account funds can be accessed by dependents at age 18.

According to Whitehouse.gov, Trump Accounts for newborns will be seeded with a one-time government contribution of $1,000. This is for U.S. citizen children born between 2025 and 2028. According to the website, large companies like Dell, Goldman Sachs, and Uber have indicated interest in the initiative.

For help navigating these changes and managing employee benefits with ease, book a call with our Employee Benefits team HERE.

This blog post is not intended to provide advice, nor is it a substitute for advice from a qualified expert. The information may not be accurate or complete and should not be relied on as such.

Sources:

H.R.1, the One Big Beautiful Bill Act, Enacted July 4, 2025 | ADP

Trump Accounts Will Chart the Path to Prosperity for a Generation of American Kids | WhiteHouse.gov

Frequently Asked Questions about Educational Assistance Programs | IRS

Dependent Care | FSA Feds

Getting Started with Telehealth | Telehealth.hhs.gov

Direct Primary Care | American Academy of Family Physicians