Employee or Independent Contractor Status When Enforcing the FLSA

See How We're Different

or call us: (858) 384‑1506

Independent contractor status under the Fair Labor Standards Act (FLSA) is a confusing topic business owners often ask us about.

It’s one thing to agree with a worker that they are an independent contractor and even have an agreement stating this, but it’s another to carry out an independent contractor working relationship…herein lies the root of much of the confusion!

This blog post aims to help you:

- See the differences between an independent contractor and an employee

- Determine independent contractor or employer status when enforcing the Fair Labor Standards Act (FLSA)

- Understand working status versus working relationship

Please note: This blog post is intended to raise awareness of independent contractor misclassifications. It is not legal advice. Laws and modifications could occur at any time, and you should always review the latest updates directly from the Department of Labor.

Okay, let’s get started!

What are the consequences of misclassifying an employee as an independent contractor?

The misclassification of employees as independent contractors can lead to major consequences, such as financial penalties for violating labor and workers’ compensation laws, not to mention the cost of back wages and back taxes including payroll taxes, plus penalties and interest. Also, misclassification can lead to damaged relationships, and further inequities often experienced by marginalized workers.

How do you know if someone is an employee or independent contractor?

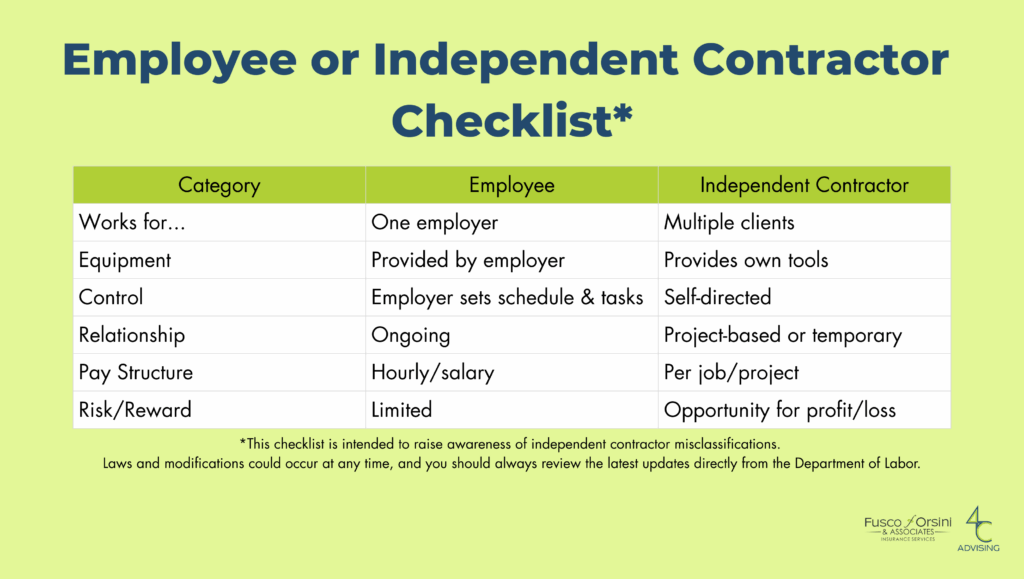

The U.S. Department of Labor (DOL) breaks down the differences between employees and independent contractors on its website HERE. Here’s a summary:

- An independent contractor is in business for themselves, whereas an employee works for someone else’s business.

- To earn more money, an employee usually must work more hours, while an independent contractor can increase its profit through business decisions.

- An independent contractor will typically supply its own tools and equipment, while an employee uses those provided by their employer.

- An independent contractor may engage clients temporarily until a project concludes, while an employee will continue an indefinite relationship with their employer.

- An independent contractor typically works with multiple clients, whereas an employee typically works for one company.

- An employer determines when and how an employee’s work is done, while an independent contractor can decide when and how they will perform their work.

- An employer assigns its employees work, while an independent contractor can select which projects it will take on.

But wait, there’s more to consider…

The list above may seem straightforward, but another layer to consider is the “economic reality” of the worker’s relationship with the employer. The DOL says, “The employer-employee relationship under the FLSA is tested by “economic reality” rather than “technical concepts.”

According to Fact Sheet #13: Employment Relationship Under the Fair Labor Standards Act (FLSA), among the factors which the U.S. Supreme Court has considered significant are:

1) The extent to which the services rendered are an integral part of the principal’s business.

2) The permanency of the relationship.

3) The amount of the alleged contractor’s investment in facilities and equipment.

4) The nature and degree of control by the principal.

5) The alleged contractor’s opportunities for profit and loss.

6) The amount of initiative, judgment, or foresight in open market competition

with others required for the success of the claimed independent contractor.

7) The degree of independent business organization and operation

Misclassification Mistakes

When evaluating the nature of a working relationship, here are a few common questions: Do they work from home? Do they work at multiple job sites? What if they have their own tools? Just because these circumstances exist does not necessarily mean a worker is an independent contractor. That’s why it’s important to answer every question on the lists above, when determining one’s working status. Seek your HR advisor or legal counsel if you need more help determining employee status.

What is the Fair Labor Standards Act (FLSA)?

The Fair Labor Standards Act (FLSA) “applies whenever there is an employment relationship between an employee and an employer.” Employers are responsible for determining if a worker is an employee under the Fair Labor Standards Act FLSA.

The FLSA “establishes minimum wage, overtime pay, recordkeeping, and youth employment standards affecting employees in the private sector and in Federal, State, and local governments,” says the DOL, which also states that “a worker is entitled to minimum wage and overtime pay protections under the FLSA when there is an employment relationship between the worker and an employer and there is coverage under the FLSA.”

Are all employees under FLSA?

According to the DOL, for a worker to be protected by the minimum wage and overtime pay requirements of the FLSA, the worker must be an “employee” of the employer.

Some employees are “non-covered” employees, while other “exempt employees” may be covered by the act, but exempted from certain provisions. See exemptions here. Seek your HR advisor or legal counsel if you need help determining exemptions.

Do independent contractors have the protections of the FLSA?

No, independent contractors do not have the protections of the FLSA because they are in business for themselves.

When does misclassification occur?

Misclassification occurs when an employer treats a worker who is an employee under the FLSA as an independent contractor.

What’s new?

On May 1, 2025, the DOL issued Field Assistance Bulletin (FAB) 2025-1 on how to determine employee or independent contractor status when enforcing the Fair Labor Standards Act (FLSA).

In the FAB, it states, “…WHD will no longer apply the 2024 Rule’s analysis when determining employee versus independent contractor status in FLSA investigations. WHD will enforce the FLSA in accordance with Fact Sheet #13 (July 2008)*, and as further informed by Opinion Letter FLSA 2019-6 with respect to any matters for which no payment has been made, directly to individuals or to DOL, for back wages and/ or civil money penalties as of May 1, 2025.”

Employers should continue to monitor the situation for updates.

P.S. – If you are navigating the complexities of maintaining or growing a team, please reach out to our HR Advisory team for support. Book your own 20-minute info call here.

###

Sources:

Field Assistance Bulletin No. 2025-1 | U.S. Department of Labor Wage and Hour Division

Fact Sheet #13: Employment Relationship Under the Fair Labor Standards Act (FLSA) and summary | U.S. Department of Labor Wage and Hour Division

Wages and the Fair Labor Standards Act | U.S. Department of Labor Wage and Hour Division

Misclassification of Employees as Independent Contractors Under the Fair Labor Standards Act | U.S. Department of Labor.

DOL Issues Guidance on Independent Contractor Misclassification Enforcement | Zywave