What Insurance Does My Restaurant Need?

See How We're Different

or call us: (858) 384‑1506

Restaurant insurance can help protect you from losses due to common risks, such as slips and falls, equipment breakdowns, cuts, and kitchen fires. There are 10 different types of insurance coverages to consider, and this blog post gets to the meat of the matter: what insurance does my restaurant actually need? Additionally, we provide real-world scenarios that can further inform you as you shop for, or refine, your policy.

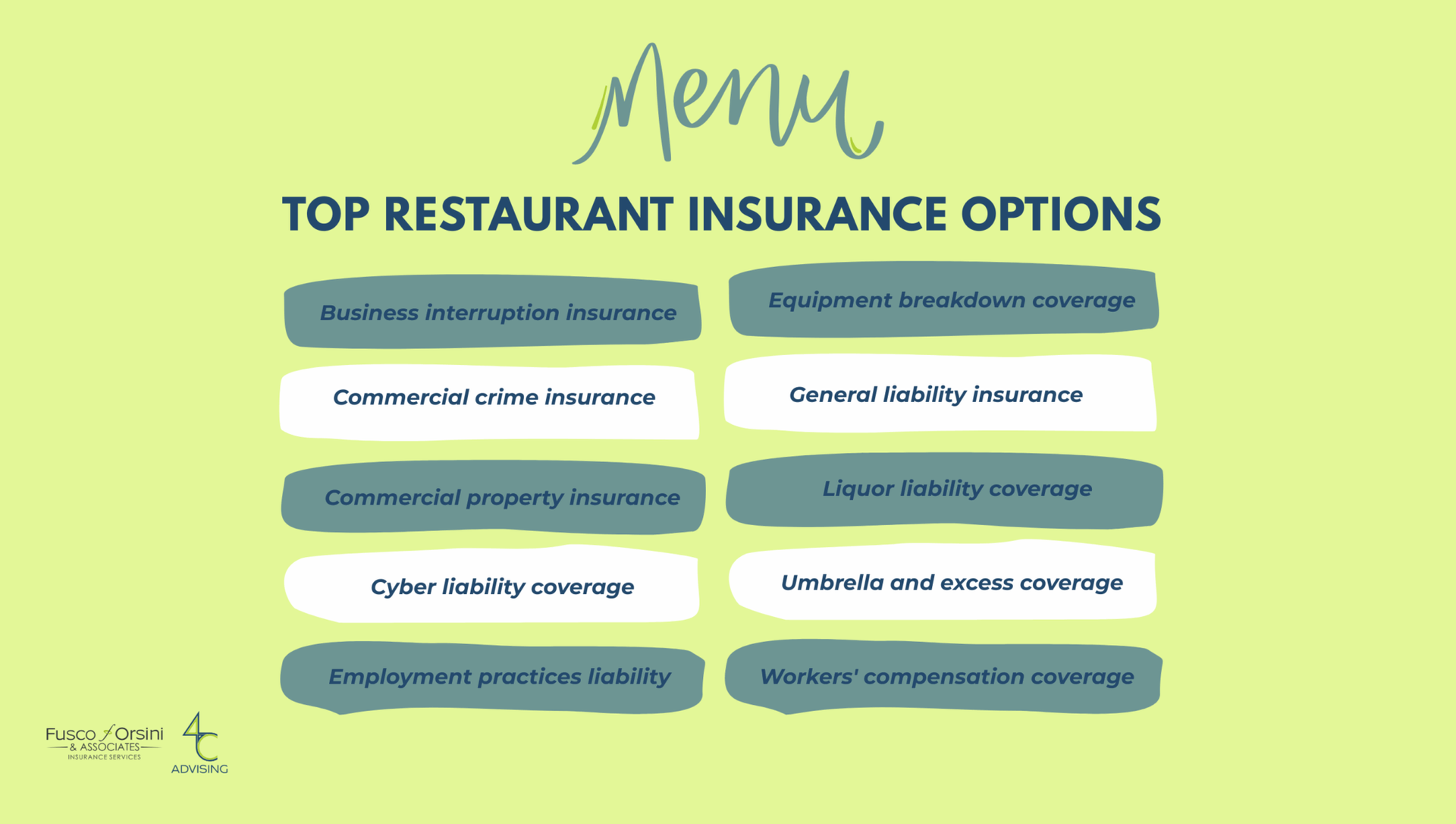

What types of insurance do restaurants need?

Here are the 10 types of insurance coverage considerations for restaurants.

- Business interruption insurance

- Commercial crime insurance

- Commercial property insurance

- Cyber liability coverage

- Employment practices liability insurance (EPLI)

- Equipment breakdown coverage

- General liability insurance

- Liquor liability coverage

- Umbrella and excess coverage

- Workers’ compensation coverage

Do you need all 10 of them? It depends on your unique business and its specific risks, which is why it’s important to talk to an advisor experienced in the restaurant industry. We can help you tailor a coverage plan that fits your needs. Get started HERE.

What real-world risks do restaurant owners face?

Restaurant owners face several exposures, meaning several areas of potential for financial loss or damage. According to Zywave, seven key exposures include property, occupational safety, employment practices, employee dishonesty, general liability, food and liquor liability, and cyber risk.

To help explain these exposures, here are real-world scenarios and the insurance that can help protect you in the wake of these scenarios.

Property: If you are running a restaurant, you are likely operating in a commercial space. Properties come with a host of challenges, including busted pipes, mold damage, power outages, and more. Outside forces, such as weather, pests, and vandals, can also cause damage to a property.

Real-world scenarios:

A grease fire breaks out in the kitchen, damaging cooking equipment, walls, and the ceiling.

A thief breaks in and steals POS systems, cash registers, and electronics.

A car crashes into the restaurant’s outdoor patio, destroying furniture and part of the structure.

Protection: A comprehensive commercial property insurance policy for restaurants typically covers building and interior improvements, kitchen equipment and furnishings, refrigerated inventory, signs, menus, and decor, as well as lost income from closures (if you add business interruption coverage).

Occupational Safety: From cuts to slips, trips, and burns, on-the-job injuries and illnesses can happen, and you could be held responsible for your workers’ subsequent hospital bills, treatments, and lost wages. In 2019, 93,800 nonfatal injuries and illnesses were reported among full-service restaurant workers. The incidence rate was 88.3 cases per 10,000 full-time workers. (U.S. Bureau of Labor Statistics)

Real-world scenarios:

A chef develops repetitive strain injury from years of prep work and chopping.

A delivery driver employed by the restaurant is injured in a car accident while on the job.

A kitchen worker is exposed to harsh cleaning chemicals and experiences respiratory issues.

Protection: Proper safety training and PPE should never be overlooked! Nor should workers’ compensation insurance, which is required by most states. Workers’ comp can help cover medical expenses for work-related injuries or illnesses, lost wages during recovery, disability benefits, rehabilitation costs, and even death benefits for families in the case of fatal injuries.

Employment Practices: Employment practices account for the policies, behaviors, and procedures a business uses in managing its employees throughout the entire employment lifecycle, from hiring to employee separation.

Real-world scenarios:

An employee complains on social media about kitchen conditions, then is fired shortly after. They claim retaliation.

A dishwasher is let go during a slow season and alleges it was because of their age.

A former employee claims they were passed over for a promotion due to racial bias and sues after a less-qualified candidate was selected.

Protection: Employment practices liability insurance (EPLI) can assist with defense costs associated with lawsuits related to how you hire, manage, and terminate employees.

Employee Dishonesty: Sadly, dishonest employees may engage in criminal acts for their own gain.

Real-world scenarios:

A manager pockets cash from the register over several months.

A bartender voids drink orders and keeps the cash.

A chef steals kitchen inventory to resell elsewhere.

Protection: Commercial crime insurance can typically help cover losses resulting from the theft of money, inventory, or property by employees, embezzlement, fraud, theft of customer information and more.

General Liability: Restaurant owners could be held liable for losses when third parties (e.g., patrons, suppliers, or passersby) experience injuries at their restaurant.

Real-world scenarios:

A delivery driver trips over an uneven sidewalk while dropping off supplies and files a claim.

A guest claims food poisoning after eating at your restaurant and seeks compensation.

A neighboring business claims smoke damage from your kitchen affected their merchandise.

A competitor sues you for allegedly copying their ad design.

Protection: General liability insurance can protect your business against third-party claims involving bodily injury (like slips and falls), property damage, or personal and advertising injury.

Food and Liquor Liability: From making sure food is free of contaminants to communicating potential allergens and serving alcohol responsibly, restaurants face several health hazards daily.

Real-world scenarios:

A customer gets sick after eating undercooked chicken and sues your restaurant.

Someone has a severe peanut allergy reaction due to incorrect labeling or cross-contamination.

A shard of glass in a salad injures a guest’s mouth.

Protection: Food and Liquor Liability Insurance covers foodborne illnesses, allergic reactions caused by undisclosed ingredients, spoiled or contaminated food served, and injuries caused by foreign objects, like bones, glass, and plastic.

Cyber Risk: Increasingly, restaurants are relying on technology to manage records, process customer payments, make customer reservations, and more. Greater reliance on technology can make restaurants more vulnerable to breaches and digital attacks.

Real-world scenarios:

A phishing email tricks a staff member into clicking a malicious link, giving attackers access to payroll and employee data.

A third-party delivery app that your restaurant partners with is breached, exposing customer addresses and payment information.

Wi-Fi used by guests and staff is not properly secured, allowing hackers to spy on devices connected to the network.

Protection: Cyber liability coverage can help cover your restaurant in the event of a data breach (think IT, legal fees, notification costs, etc.), fraud, ransomware recovery and payments, regulatory fines and penalties, and more.

We hope these scenarios give you a better understanding of some everyday risks restaurants face.

Running a business without insurance and risk management is like putting a pot of water on high heat and walking away. At first, everything is fine, but as the heat builds, pressure rises, and without your attention, it eventually boils over and maybe even burns the kitchen down.

Insurance is like turning down the heat, adding a lid, or setting a timer. It’s not just a task-list item that you buy; it’s a tool to help you recover, protect your assets, and prevent disaster.

Insurance is a tool to keep your legacy going.

Whether you have insurance or not, we’re here to help you make informed decisions about the insurance and risk management you actually need for your restaurant.

Get started HERE.

Sources:

Insurance Considerations for Resturant Owners | Zywave

93,800 nonfatal injuries and illnesses in full-service restaurants in 2019 | U.S. Bureau of Labor and Statistics

OpenAI. (2025, July 2). Response to a question about Real-World Scenarios in the Restaurant Industry using ChatGPT [Large language model]. https://chat.openai.com/