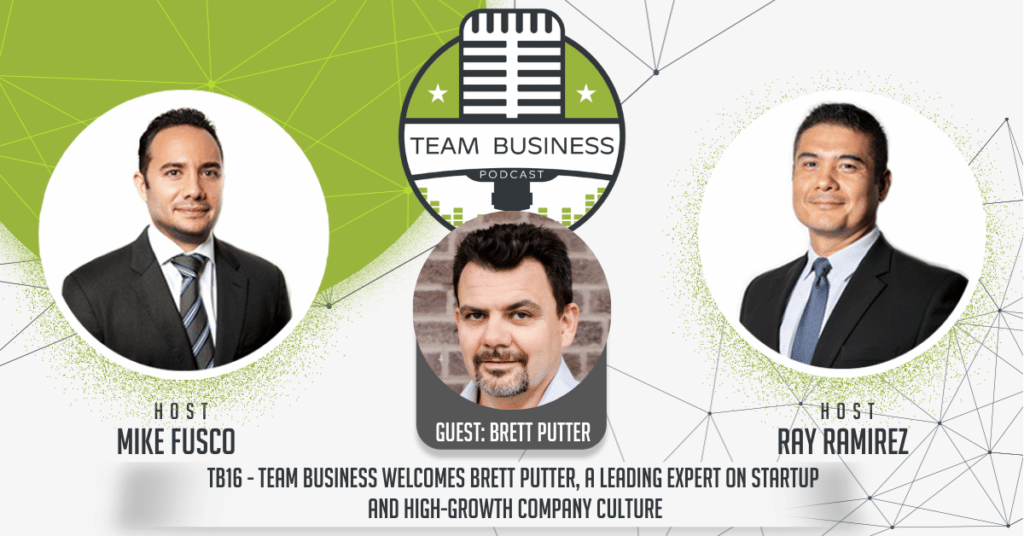

TB16 – Team Business Welcomes Brett Putter, a Leading Expert on Startup and High-Growth Company Culture

In this episode of the Team Business podcast, co-hosts Mike Fusco and Ray Ramirez welcome Brett Putter, a leading expert on startup and high-growth company culture. Brett is also the author of ‘Culture Decks Decoded‘ and ‘Own Your Culture.’ Episode…